|

HOW TREASURY CAN GET BUY-IN AND BUDGET FROM CFOs

Craig Chapman, Manager at Actualize Consulting explains how can treasury get buy-in from CFOs when it comes to tech investment Overall, one of the mandates from CFOs is to foster a centralized and control-proof source of data for liquidity management, forecasting, payments, cash and financial accounting, funding, investments and risk management. Besides the multiple ways that a Treasury Management System (TMS) can add immediate and recurring value to the CFO and Treasurer, the best “new development” in TMS is the affordability. The value of having a TMS has never been as compelling as it is today. Combined with the SaaS pay-as-you-go subscription model, the ROI for treasury technology is very strong today. But, how do you get the CFO to buy-in and allocate the funds for investing in technology or a TMS? Formulating your future state vision At some level, there is always a vision the client is striving to achieve. You have envisioned the final product, but to get the CFO on board, you must align your vision to their finance transformation goals. Why and how an investment in technology is needed must be backed up with data and detailed information gathering. You must build a strong business case that will gain approval for the necessary budget allocations. To formulate an accurate and documented vision, capturing information through questioning primary stakeholders is critical. One approach is to capture your current state and desired future state once technology has been implemented by business function or process. When defining the future state vision, include all levels of the team in the discussions to improve engagement as well as to understand the underlying reasoning for the decisions made and true deficiencies on the current state. This can also be expanded to capture more technical components such as system administration, integration with other systems, straight-through processing, and system controls. These are the key questions to ask before presenting your future state vision to the approval of CFOs of the proposed project:

The implementation of technology or a TMS provides an organization with many benefits. Aligning the benefits with the CFOs goals is important. They are responsible for proactively managing, implementing improved financial controls, and to ensure effective risk mitigation plans are in place. The introduction of treasury technology is one way to implement such controls, so benefits should follow this theme. While many are familiar with the obvious benefits, sharing the holistic perks that evolve will strengthen your case:

The CFO plays a vital role in influencing their company’s strategy and growth. CFOs need to transform their finance operations to become a better strategic business partner for their organizations. Entering the international market with a Treasury Management System and a growth agenda designed to support the complexity of a global business while leveraging automation is paramount. The TMS implementation plan should show that the technology can evolve to accommodate and expedite the company’s global expansion plans. By enhancing your global treasury functions, you also gain the ability to:

Reduction in Bank Fees: Bank Fee Analysis and reduction of transactions Achieve optimal long-term structure International remote capability A final business case should be submitted for approval and should include a cost-benefit analysis. The business case should include all the factors discussed previously: Current State and Future State Vision, TMS Benefits and the ability to support a global growth strategy, and the cost-benefit analysis. A comprehensive approach is needed on many levels to gain the support of CFOs. Gaining support will eliminate unnecessary stress and energize all phases of your implementation. Continued communication and collaboration help navigate and smooth any bumps along the road of reaching your end goal. The goal is for technology to be an integral part of your Finance departments current and future expansion goals. As your company evolves, so should your technology.

0 Comments

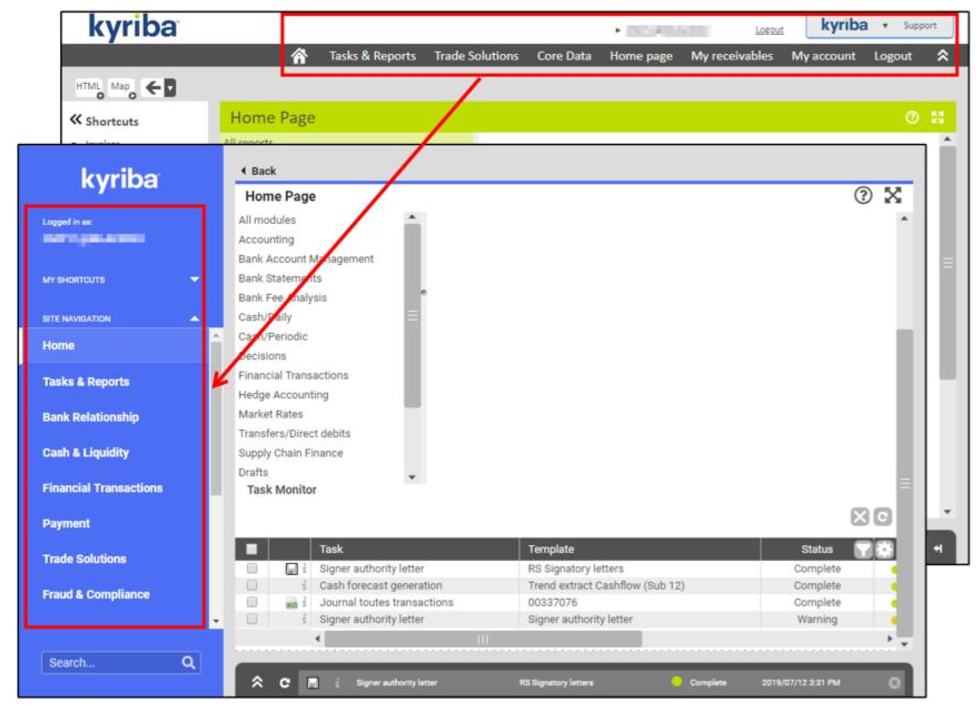

As Kyriba rolls out version 19.2, we can find several key changes made to enhance user experience. Please view the link below to learn more about how you can leverage the new User Interface New User Interface 19.2 Guide HOW MUCH LONGER WILL BANKS HAVE THE MONOPOLY ON TREASURY SERVICES?

Lionel Taylor at Trade Advisory Network and Warrick Carey Manager at Actualize Consulting share their views. Lionel Taylor Co-Founder at Trade Advisory Network: There is much debate around the threats that banks are facing with the advent of fintech and the disruption this will cause to their businesses. There is no doubt that the aftermath of the global financial crisis damaged the reputation of the banking world and led to a period of introspection, coupled with increased regulatory resilience measures. As a result, banks must hold more capital to cover the perceived risks of their activities as a requirement. In the meantime, fintechs were able to exploit the weaknesses in the banking system with the promise that new technologies would transform the provision of banking services, whether or not the banks were ready to play. In the last few years, banks have repositioned themselves, with some deciding to focus activity on specific countries, product areas, or the servicing of particular customer segments. Much of this has affected their provision of services to the SME market rather than the major and global corporate companies. Banks have also begun to embrace the world of fintech by adopting the new technologies, and joining transformation programmes to change some of the paper driven and commoditised services into digitised and streamlined processes. However, there is much evidence to show that fintechs and other companies that provide complimentary services to banks, or hold and manage mass amounts of data, are nibbling around the edges of what was once the preserve of the banks. For example, foreign exchange services, payments, and cash management are becoming readily available through non-bank service providers. Open banking and the increased availability of real-time data have created further opportunities and competition, and with treasurers being more attuned to the efficiency gains that can be achieved through these new service providers, further growth is expected. While the non-bank sector can claim to be more flexible and innovative, they do not have the history and long-standing relationships that banks and corporate companies maintain. Banks have more experience and knowledge of the treasury support required by corporates and so remain their trusted partner, despite not being able to deliver services as efficiently as some of the new players. Banks cannot rest on their laurels. As fintechs gain more experience and traction, there are now more receptive treasurers who are open to learning about their advancements and offerings. In the meantime, banks are reacting through increased collaboration with the fintech world, and, for some banking services, maintain the risk appetite and balance sheet that cannot be matched by a fintech or non-bank player. Therefore, it is my view that while the banks will not have a future monopoly on treasury services, they will retain a dominant position in the servicing of the major corporate sector. Warrick Carey, Manager, Treasury & Capital Markets at Actualize Consulting: If one were to cast their mind back ten years ago, from a corporate treasurer’s perspective, all financial services required to effect cash and risk management were largely enabled through the offerings of their organisation’s banking partners. For a long time, banks enjoyed a dominating monopoly on treasury services offered to corporates. This was before the financial crisis. When it came time for the surviving banks to dust themselves off and pick up the pieces, their focus was on getting their core operations back up and running, and attention to technological progress and advancement was relegated to the back of the queue. It was at that point that the mantle of innovation in IT and financial services was taken up by financial technology firms (fintechs) who were able to develop new products with the pace and agility that banks were unable to replicate. It was the fintechs who first championed and encouraged the use of application programming interfaces (API) in banking and finance. An API is a set of functions, communication protocols, and procedures that enable the communication between two applications or systems and facilitate the exchange of data rapidly and at a reduced cost allowing for increased operational efficiencies. These relatively new advances in technology, coupled with recent changes in banking regulations, have altered the industry landscape quite significantly and in favour of the fintechs who, up until recently, weren’t able to compete effectively with the banks without the equivalent means of product and services distribution. In March 2015, HM Treasury announced in its Budget Report that the UK government was keen to drive increased competition in the banking market to enable banks, alternative providers of financial services, and fintechs to be able to compete on even terms in winning new and retaining existing customers. Fast forward to today and the revised Payment Services Directive (PSD2) throughout the EU as well as in the UK via the Competition and Markets Authority mandated roll out of the Open Banking Standards has lowered the drawbridge on customer data held by the banks and enabled the fintechs and other enterprising third parties to harness APIs that could potentially, in the very near future, benefit treasurers immensely. APIs work at much faster speeds than batch processing or host-to-host bank connections, and as a result a corporate can obtain real-time views of their cash. They could utilise an API to go out to all their banking partners, collecting the latest view of their transactions and balances, thereby enhancing their cash management and reporting abilities, all from one platform developed by a fintech. This is instead of needing to go through individual banking portals or waiting for prior day or intraday statements to be pulled in. Instant payment capabilities have also come about through the use of APIs offered by fintechs with benefits, including instant feedback on payment status and notifications of successful submission or errors. These are just a few examples of the possibilities that fintechs are developing, leveraging the open playing field. Banks have not ignored this fact and have started building out their data strategy to include collaborations with fintechs and increasingly leverage APIs to not lose market share or the customer experience. But one thing is for certain: the current situation is vastly different and large banks may not hold the upper hand in the treasury services arena for too much longer unless they can begin to evolve as quickly as their more agile fintech competition. |

News OverviewLatest release news and tips for your Kyriba implementation. Categories

All

Actualize ServicesArchives

December 2020

|

- Home

- News

-

Kyriba ▼

- On-Boarding

- Bank Account Management

- Bank Connectivity

- Bank Fee Analysis

- Bank Statements

- Business Intelligence

- Cash & Forecasting

- Cash Accounting

- Financial Accounting

- Financial Transactions >

- Fraud & Compliance

- GL Reconciliation

- Hedge Accounting

- In-House Banking

- Netting

- Payments

- SSO/SMS

- System Administration

- Valuations

- Mid Market ▼

- Best Practices ▼

-

Actualize Resources ▼

- New Kyriba Consultants

-

Technical Resources ▼

>

- More Education ▼ >

- Bank Account Management

- Bank Fee Analysis

- Bank Connectivity

- Bank Statements

- Kyriba Reporting ▼ >

- Cash & Forecasting

- Cash Accounting

- Core Data

- Connectivity ▼ >

- Data Exchange

- Financial Accounting

- Financial Transactions

- Fraud & Compliance

- GL Reconciliation

- In-house Banking

- Liquidity Planning

- Market Data & MTM

- Netting

- Payments

- Supply Chain Finance

- System Admin & SSO

- Valuations & Risk, Hedge Accounting

- News & General ▼ >

- Project Resources ▼ >

- RPA

- Sales and Account Management

- Training Portal Requests

- Contact

RSS Feed

RSS Feed